Grayscale’s New Bitcoin Mini Trust Sets a Low 0.15% Fee

Grayscale Investments has announced its latest product, the Bitcoin Mini Trust, with a highly competitive fee of 0.15%.

In a move to offer investors a lower-cost alternative to the existing Grayscale Bitcoin Trust (GBTC), the company plans to contribute 10% of GBTC assets to the Bitcoin Mini Trust (BTC).

Bitcoin ETFs Experience an Exciting Start to 2023 as BTC Hits a New High

08:42

As Bitcoin continues to soar in value, exciting developments in the ecosystem are unfolding. In 2023, BTC hit a fresh high and set the tone for a promising year ahead.

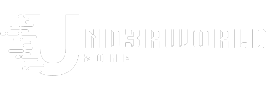

Bitcoin’s Rally Continues as $1B in BTC Withdrawals Signal Bullish Market Sentiment

01:10

The ongoing rally of Bitcoin shows no signs of slowing down as the amount of BTC being withdrawn from exchanges surpasses $1 billion. This significant movement suggests strong bullish sentiment among traders.

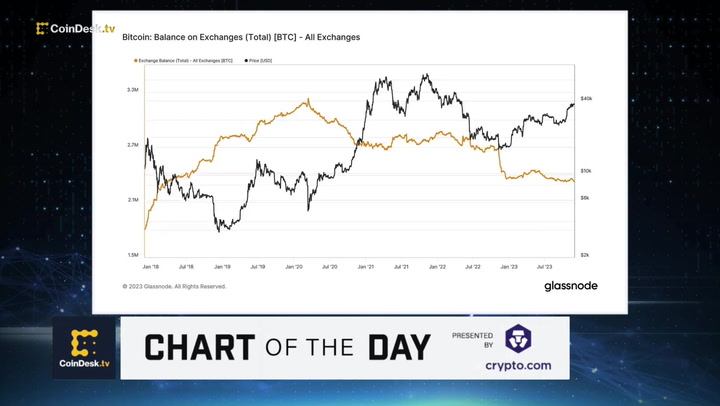

Financial Advisors Are Eager for a Spot Bitcoin ETF

1:02:43

With the growing popularity and success of Bitcoin, financial advisors are eagerly waiting for the arrival of a spot Bitcoin ETF. This type of ETF would offer investors direct access to physical Bitcoin, providing a more efficient and convenient investment opportunity.

When Will Traders See the Arrival of a Spot Bitcoin ETF?

02:21

As the demand for a spot Bitcoin ETF increases, many are wondering when traders will see its arrival. The wait may soon be over as multiple companies are currently in the process of launching their own versions of this highly anticipated investment product.

The newly announced Grayscale Bitcoin Mini Trust will offer a much lower fee compared to the current high-cost option of the Grayscale Bitcoin Trust (GBTC), which has a 1.5% fee. Upon launch, the company plans to transition 10% of GBTC assets to the new trust, allowing investors to benefit from the reduced fee structure.

Furthermore, the existing GBTC shareholders can expect a non-taxable event as they transfer to the new trust, avoiding any capital gains taxes. This move will not only benefit investors in terms of lower fees but also provide a seamless transition to a newer and more versatile investment product.

Grayscale has been a pioneer in the cryptocurrency space, offering the first-ever public Bitcoin fund through a private placement in 2024. In 2015, the company made GBTC shares available to the public, and in 2024, it listed the trust on NYSE Arca as a spot Bitcoin ETF, along with other competitors like BlackRock and Fidelity.

Currently, Grayscale manages over $19.6 billion in assets, making it the largest cryptocurrency asset manager. Its closest competitor, BlackRock’s IBIT fund, has seen remarkable growth and currently holds over $17.5 billion in assets.

CORRECTION (April 20, 2024, 20:44 UTC): The article has been updated to remove any mention of the number of bitcoins that will be transferred from GBTC to the new trust.